(Palm Coast Local) - In a significant move poised to dramatically reduce the expenses associated with buying and selling homes, the National Association of Realtors (NAR) announced on Friday March 15, 2024 a settlement with groups of homesellers. This agreement, marking the end of landmark antitrust lawsuits, involves a payment of $418 million in damages and the removal of regulations regarding commissions.

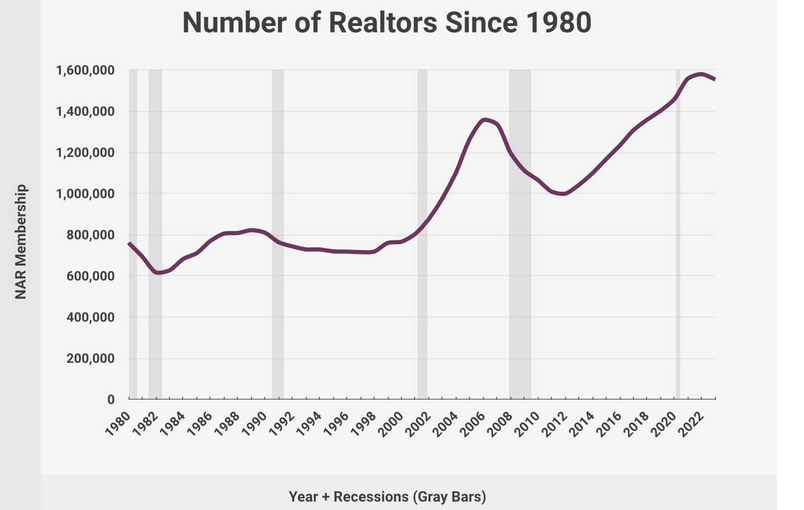

According to Ruby Home the Number of Realtors in the United States tops 1,554,604 (members of the National Association of Realtors) in the United States among an estimated 2,000,000 real estate agents (licensed, but not members of the National Association of Realtors). Florida holds 225,563 of them.

|

Representing over 1 million Realtors, the NAR has also committed to implementing new regulations. One such rule prohibits including agents’ compensation on listings placed on local centralized listing portals, known as multiple listing services (MLS). Critics argue that this practice incentivized brokers to prioritize more expensive properties. Additionally, another rule eliminates the requirement for brokers to subscribe to multiple listing services, many of which are owned by NAR subsidiaries, where homes are widely viewed in the local market. Furthermore, a new regulation mandates that buyers' brokers must enter written agreements with their clients.

This agreement is expected to revolutionize the current model of home buying and selling, wherein sellers cover the costs of both their broker and the buyer's broker, a factor critics claim artificially inflates housing prices. According to TD Cowen Insights, real estate commissions could decrease by 25% to 50%, opening opportunities for alternative selling models such as flat-fee and discount brokerages.

Following the announcement, shares of real estate firms Zillow and Compass plummeted by more than 13%, reflecting investor concerns about reduced commission rates potentially impacting agent business on real estate platforms. Conversely, stocks of homebuilders experienced gains, with Lennar shares rising by 2.4%, PulteGroup by 1.1%, and Toll Brothers by 1.8%.

The settlement signals a significant shift in the real estate landscape. For the average-priced American home, sellers currently pay over $25,000 in brokerage fees, costs that are passed on to buyers and inflate home prices. However, with the potential for these fees to decrease by $6,000 to $12,000, according to TD Cowen Insights, the market could become more accessible to buyers.

Kevin Sears, president of the NAR, emphasized the long-term benefits of the settlement, despite its substantial cost. The agreement follows a federal jury ruling in November, which found the NAR and two brokerages liable for $1.8 billion in damages for conspiring to maintain artificially high agent commissions. This settlement, subject to judicial approval, is poised to foster a more competitive housing market, empowering buyers to negotiate rates and encouraging brokers to advertise competitive fees.

The settlement may trigger a significant departure of brokers from the industry, potentially resulting in the exit of up to half of the approximately 2 million agents in America.

With reduced fees, less proficient agents are expected to exit the profession, while top brokers stand to gain more business. This development represents years of challenges for the NAR.

The NAR has been embroiled in legal battles with US antitrust authorities for some time over allegations of anti-competitive practices. However, the verdict in November marked a major setback for the association, leading to the dissolution of regulations that have long upheld its compensation structure.

Moreover, the NAR is under scrutiny from the US Department of Justice, and it remains uncertain whether this settlement with sellers will impact the government's examination of the brokerage industry.

(Opinion) It won't matter the outcome for the average buyer and seller, as the power of negotiation has changed. Home buyers and sellers want better options, to be able to choose while having a say in the entire process. One aspect that will also effect local real estate agents and brokers is the referral system they have set for themselves. This practice of leading a home buyer or home seller to a specific company for services is also raising eyebrows. The 'quid pro quo' is coming to an end while giving the power back to the home buyer or seller. The conclusion, for the real estate agent or broker, the process will become transactional based.

What is your opinion? Do you believe this will change the industry for the better? Let us know in the comments.

{ampz:share-now}